My AI Stock-Picking Experiment: Can a Robot Really Build a Winning Portfolio? - Part 1

Can I actually make money by investing using AI?

Can i really make money investing using Ai ?

Lately I’ve been experimenting with AI investing tool (Value Farm) to help me understand investments, market trends, and financial decisions, and i have selected 7 stocks based on this Ai tool. You can read more about this 7 stocks here.

Before we start make sure you already subscribed to us to receive my investing journey.

This challenge is purely an experiment to see if AI alone can help me make money in stocks without deeper research. Results are uncertain and not guaranteed.

📌 Disclaimer

I am not a licensed financial advisor, accountant, or investment professional. The information I share is for educational and informational purposes only and should not be taken as financial advice. Always do your own research and consult with a licensed financial advisor or other qualified professional before making any investment or financial decisions. You are fully responsible for your own choices and actions.

Based on the guideline given on Ai Value Farm , the optimum number of stocks to buy at one time is 3–5. This is important for both investment management and fund management. If we hold too many stocks, they become difficult to manage, and we may run out of funds.

HOW TO PICK 3-5 STOCKS FROM THIS LIST?

SAMAIDEN

ALLIANZ

PEKAT

SUNCON

SLVEST

AXREIT

HLIND

Here’s how I narrowed the list down.

Step 1: Familiarity

I immediately filter for companies I know and understand. From the list, I'm familiar with:

SAMAIDEN, SUNCON, SLVEST, AXREIT, and HLIND.

SAMAIDEN

ALLIANZPEKATSUNCON

SLVEST

AXREIT

HLIND

Companies removed: ALLIANZ, PEKAT.

Step 2: Growth, Catalysts, and Risk

Next, I used the AI's "Insight" tool to analyze each company's potential and pitfalls.

Any projects coming up for the company?

Any government incentives related to this company?

Is the company moving in line with current trends?

Are there any schemes that favor this company?

What are the potential risks?

Getting these answers is pretty simple — we can find them from AI Value Farm’s AI Insight.

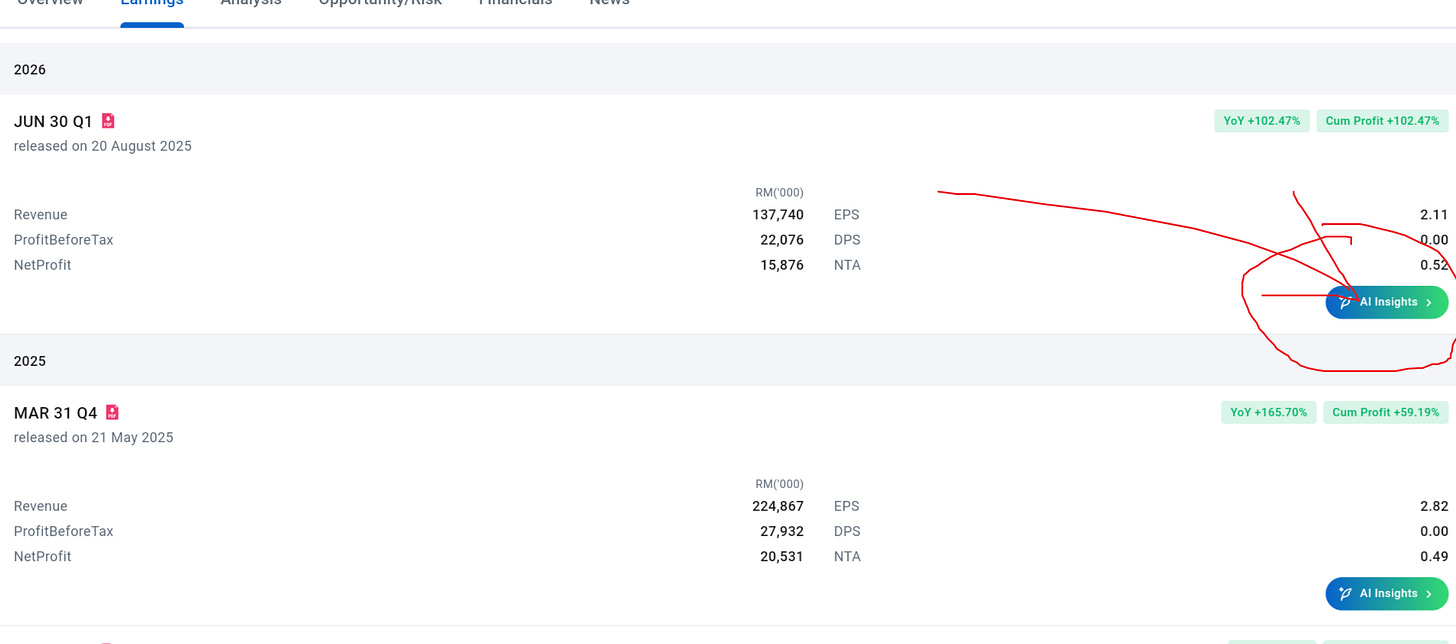

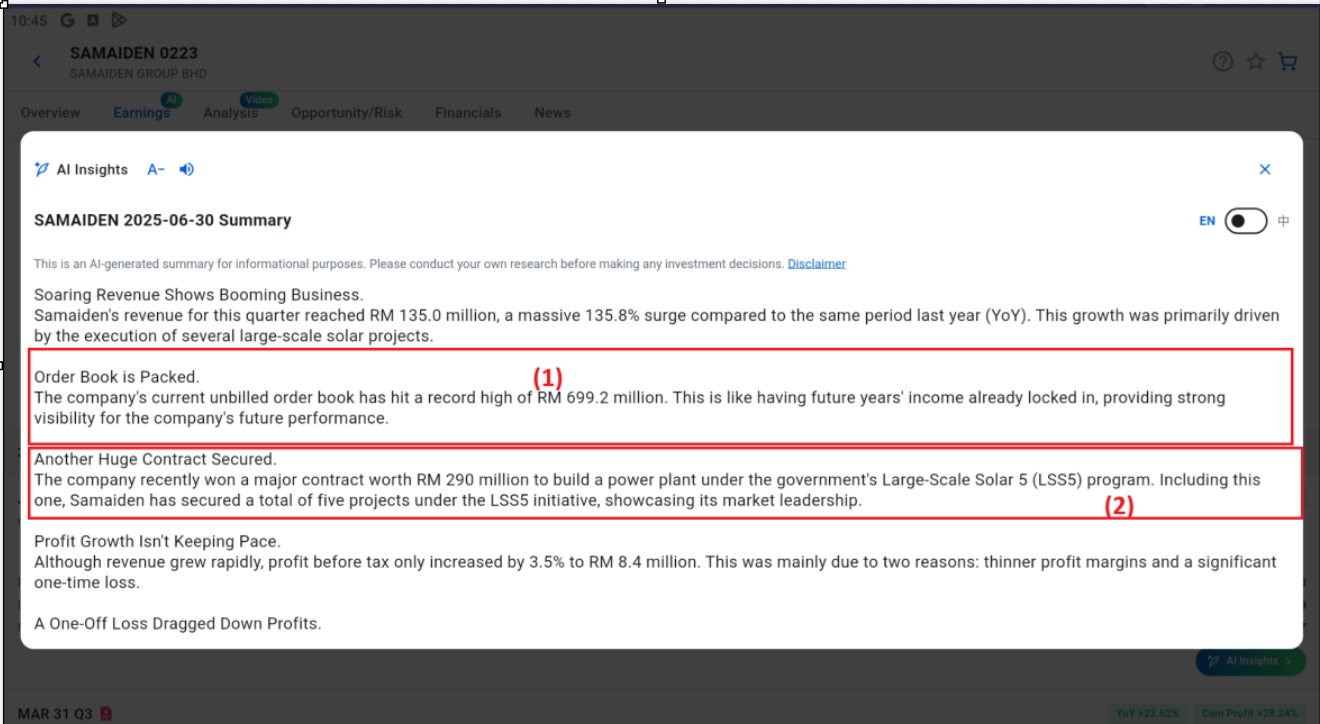

Lets Look At SAMAIDEN:

As you can see the potential growth are :

The company’s current unbilled order book has hit a record high of RM 699.2 million.

The company recently won a major contract worth RM 290 million

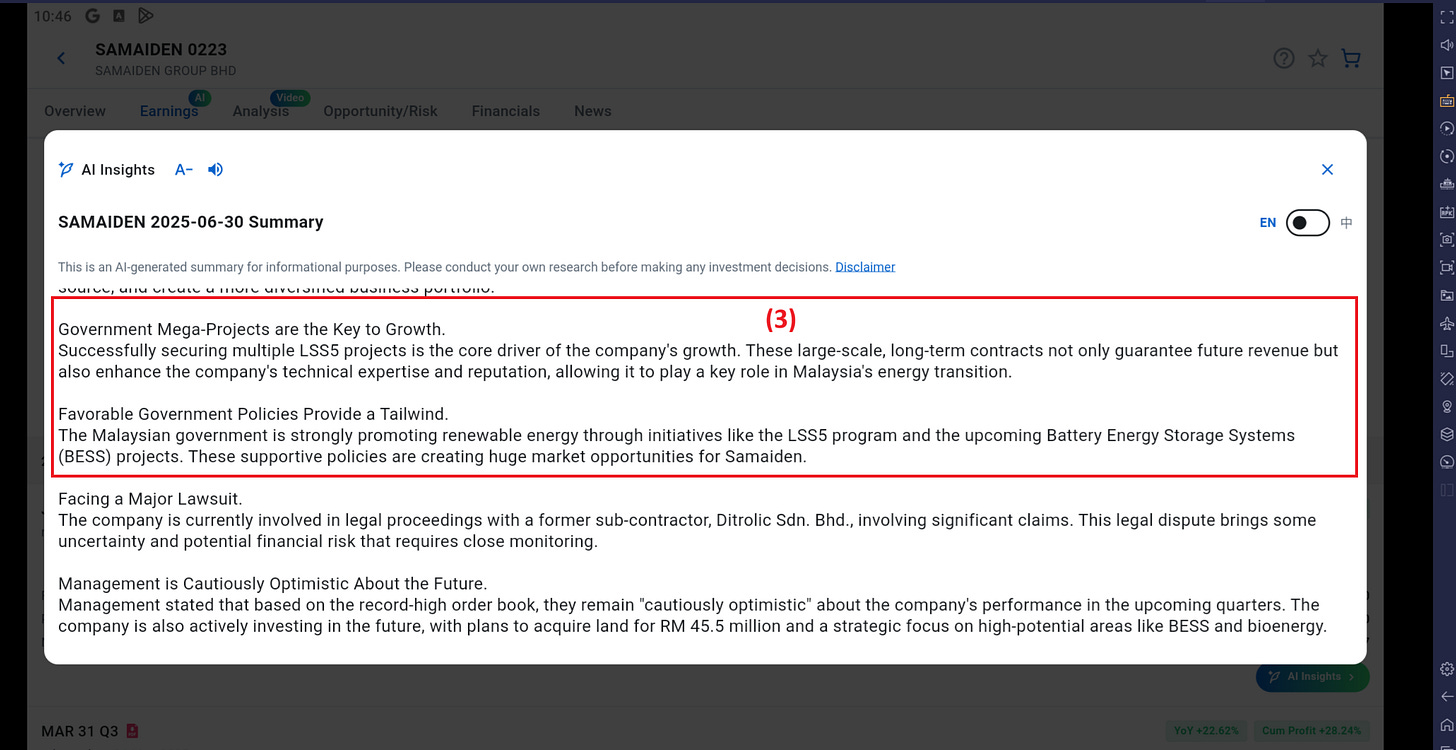

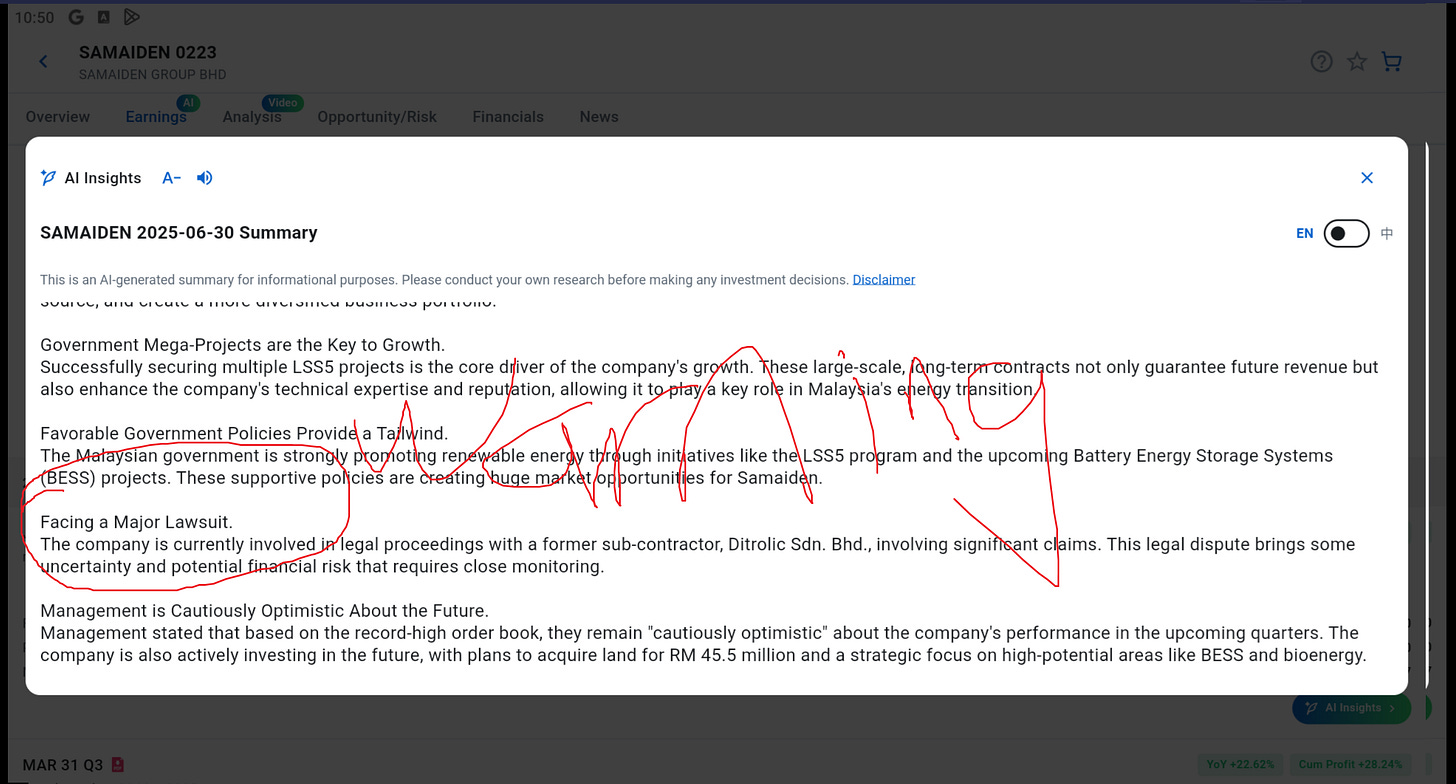

Successfully securing multiple LSS5 projects is the core driver of the company’s growth.

However ,

The risk as you can see as well, it is facing a Major Lawsuit.

This lawsuit introduces short-term risk + uncertainty, but it doesn’t erase Samaiden’s long-term growth potential in renewables.

Treat this as a risk factor, not a dealbreaker.

Diversify, monitor legal updates, and be cautious about adding new positions until there’s clarity on the case outcome.

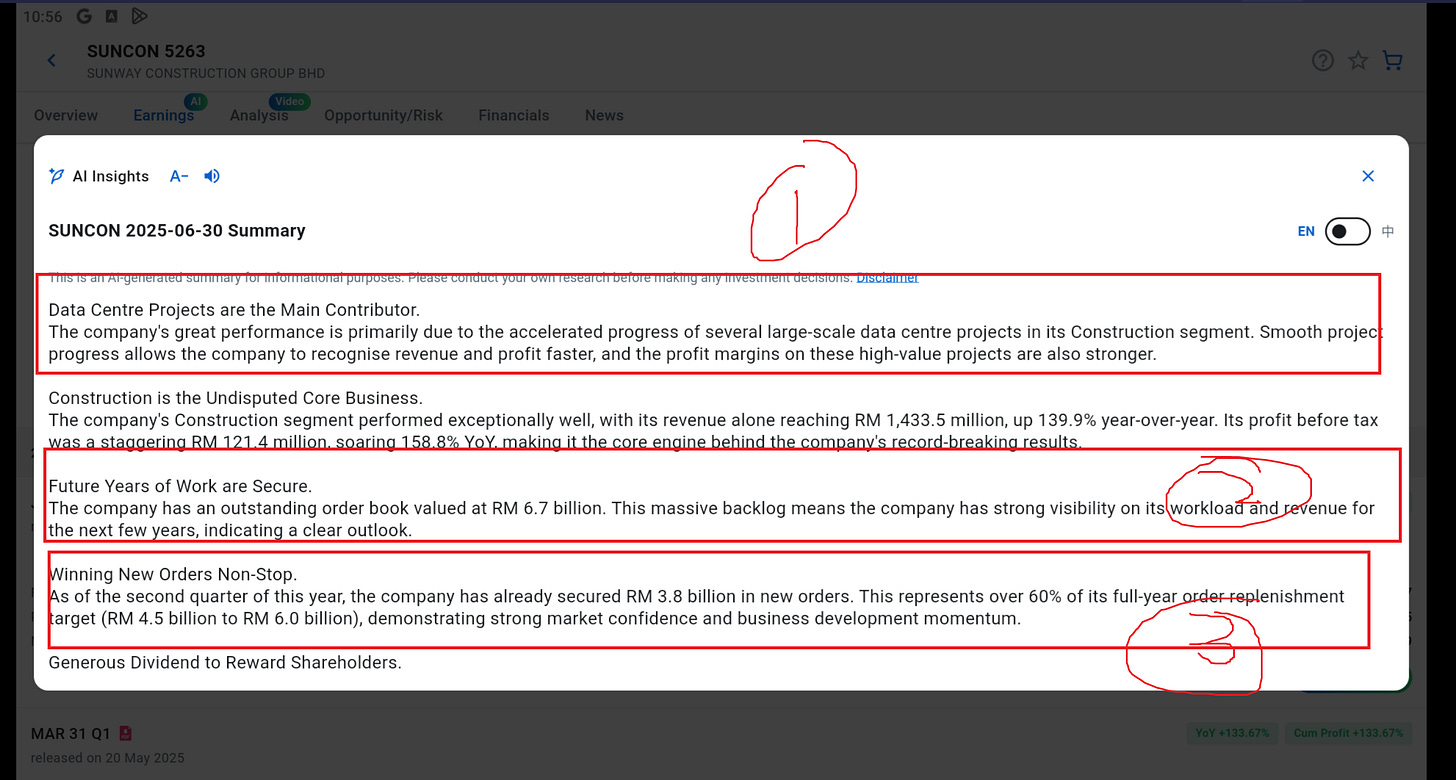

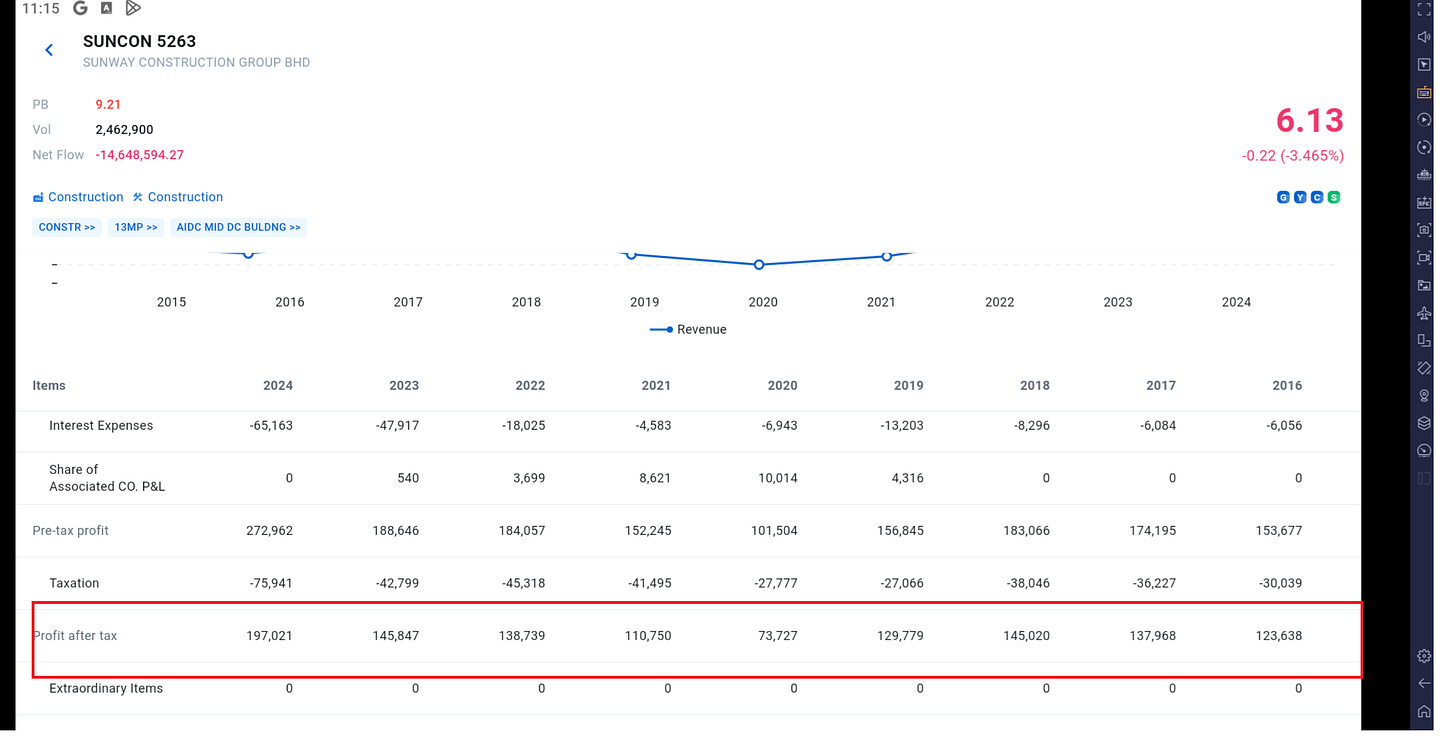

Lets look at SUNCON.

As you can see the potential growth are :

Data Centre Projects are the Main Contributor.

The company has an outstanding order book valued at RM 6.7 billion.

As of the second quarter of this year, the company has already secured RM 3.8 billion in new orders.

Sound good , what about the risk?

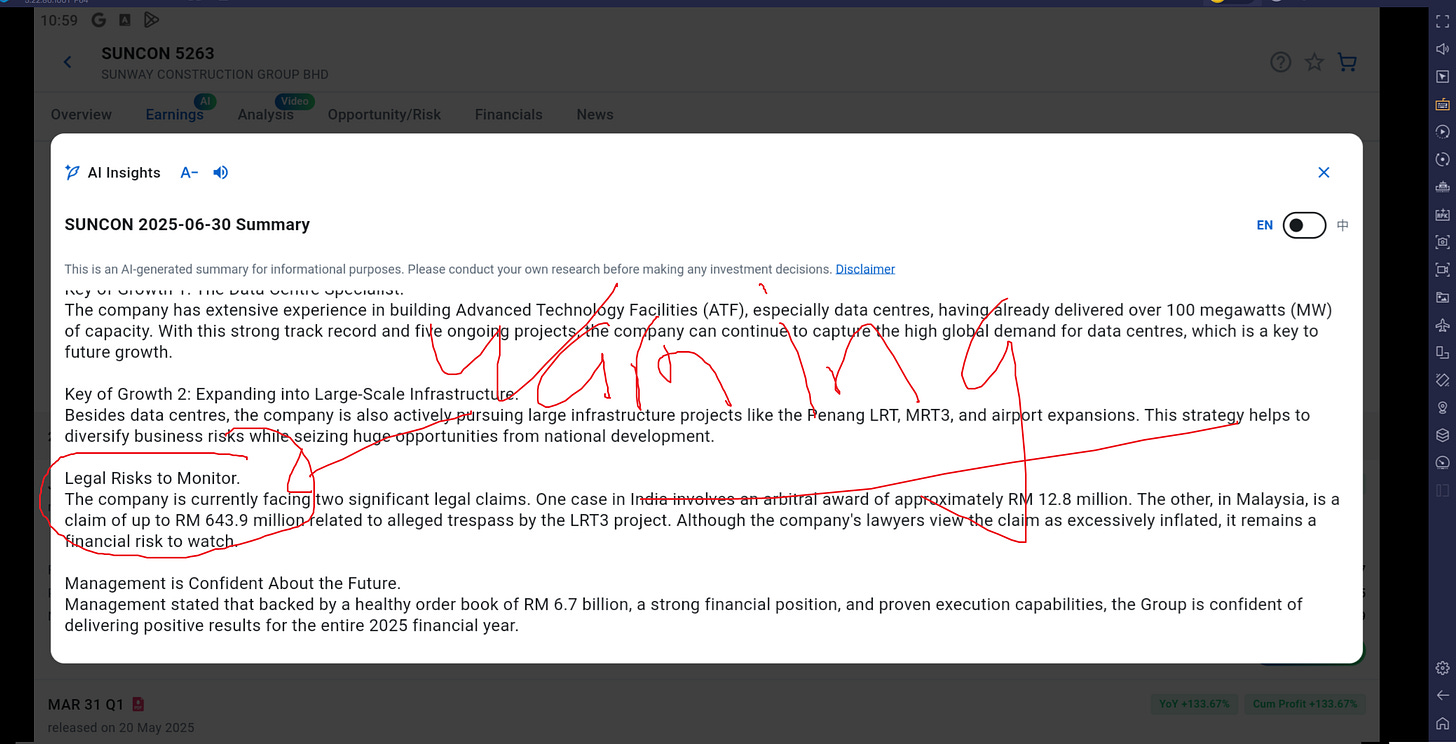

2 Major risks here:

a) The India Arbitration Award (RM 12.8 million)

With a net profit of RM 83.9 million for the quarter, the RM 12.8 million claim represents about 15% of a single quarter's earnings, it may still be a manageable one-time cost rather than a catastrophic threat.

b) The LRT3 Trespass Claim (RM 643.9 million)

Remains a severe threat, equivalent to about SUNCON’s 3 years of profit after tax.

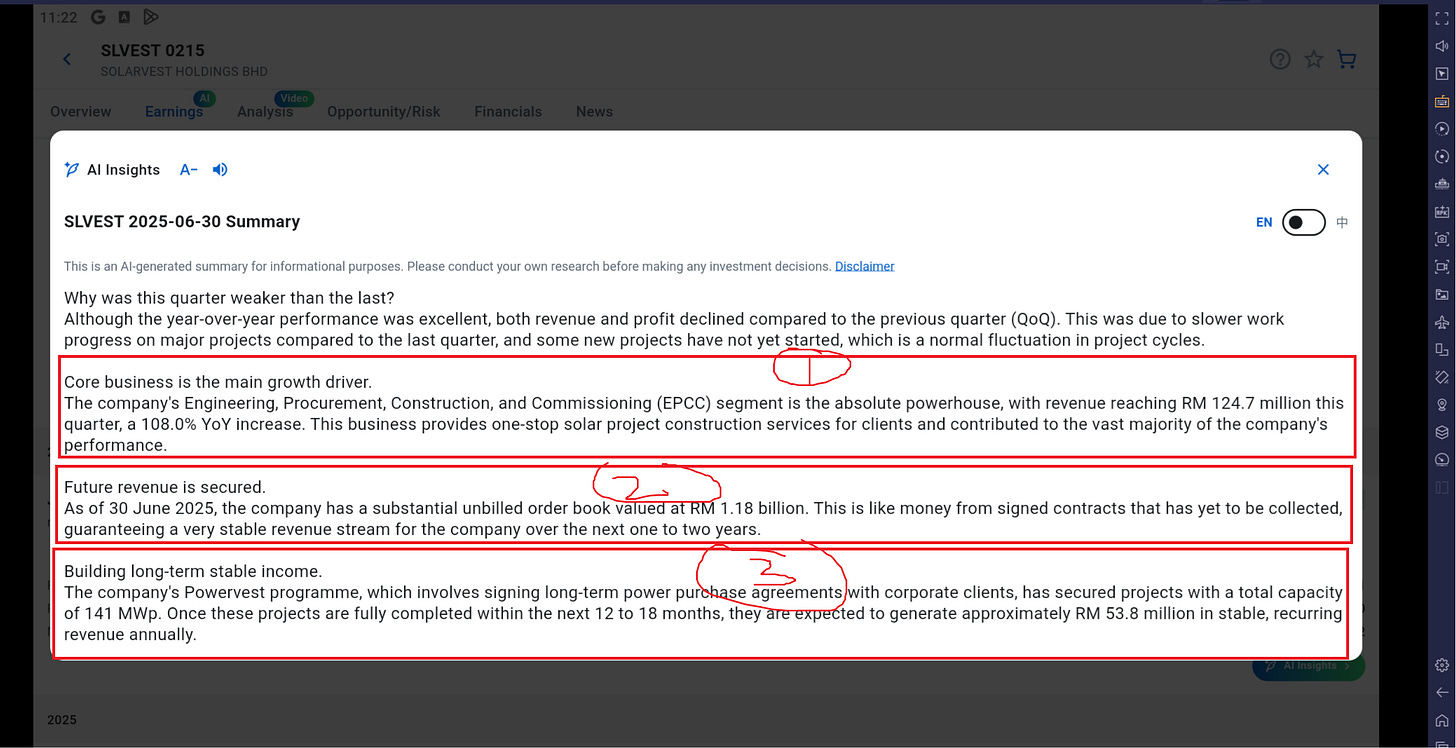

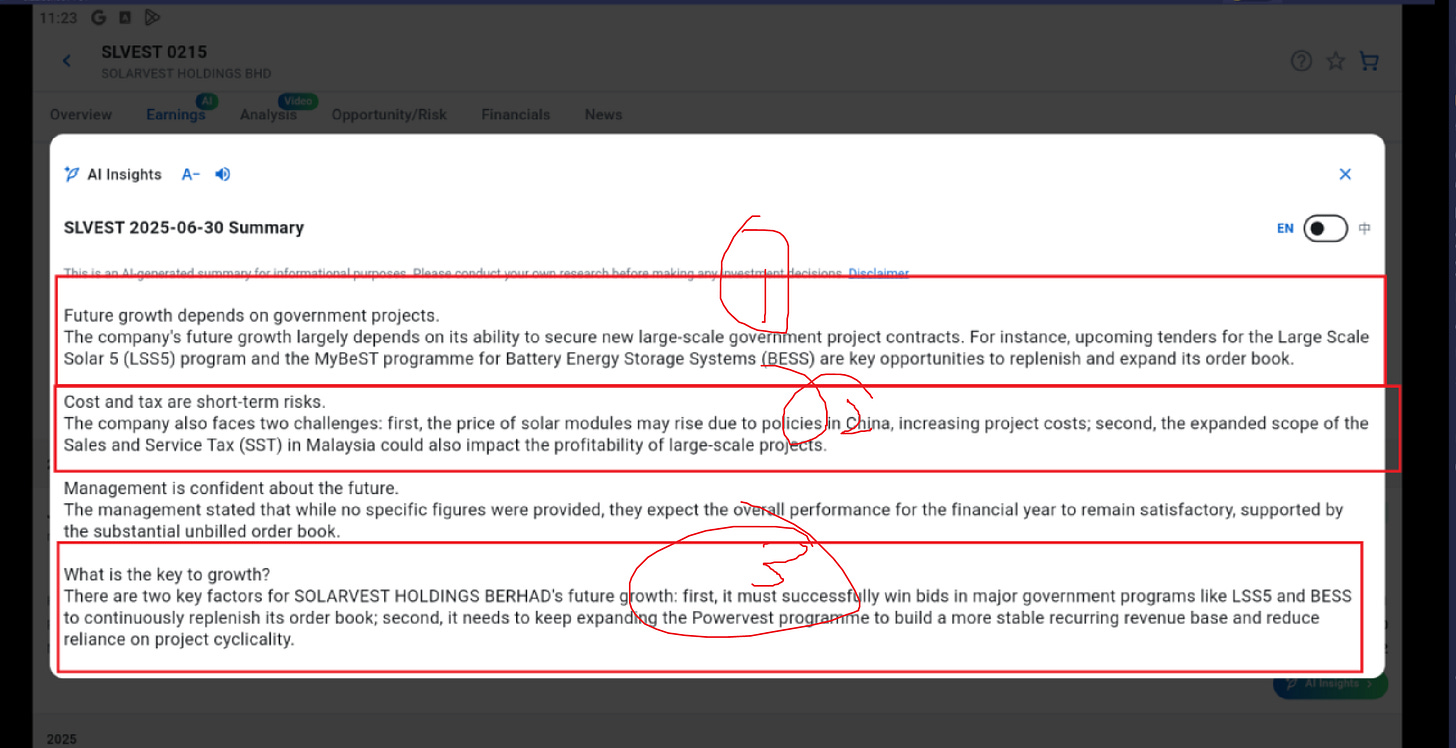

Next SLVEST:

As you can see the potential growth are :

Revenue from EPCC reached RM 124.7 million this quarter, a 108.0% year-over-year (YoY) increase.

The company has an unbilled order book of RM 1.18 billion (as of June 2025). This guarantees a stable revenue stream for the next 1-2 years, as these are signed contracts awaiting execution and payment.

Slvest is building a portfolio of long-term power purchase agreements (PPAs) under its Powerwest programme.

A couple of things to be consider:

Future growth depends on goverment project

Cost and tax are short term risks

Big annoucement is coming up. (will need to see how after this)

continue reading AXREIT & HLIND on the next update. stay tune.

📌 Disclaimer

I am not a licensed financial advisor, accountant, or investment professional. The information I share is for educational and informational purposes only and should not be taken as financial advice. Always do your own research and consult with a licensed financial advisor or other qualified professional before making any investment or financial decisions. You are fully responsible for your own choices and actions.